Detecting, quantifying and accessing impact of news events on Indian stock indices

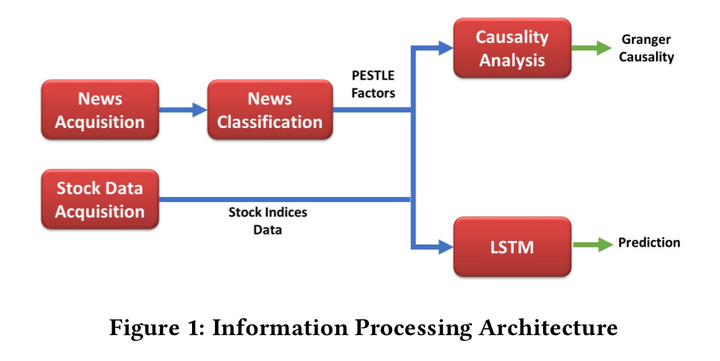

Model Architecture

Model Architecture

Abstract

The impact of different types of events reported in News articles on stock market is a widely accepted phenomenon. Market analysts rely heavily on technology to combine data from different sources and generate appropriate insights for predicting stock movements. With plethora of sources reporting news on plentitude of events happening across the world, a combination of text mining techniques and predictive technologies can play a significant role in this arena. In this paper we have presented methodologies to identify and quantify the presence of different types of information that can affect the market from a multitude of web sources, and finally use the information for predicting stock movement direction. We propose the use of PESTEL factors to categorize market-impacting information. We have analyzed large volumes of past available data using Granger causality to understand how these categories impact the market. We propose a paragraph-vector based information classification mechanism. We also present Long-Short term memory Network (LSTM) based prediction model to investigate the prediction capabilities of the information components. The proposed system outperforms state of the art linear SVM on data from different stock indices.